NorthOne Bank sign up represents a crucial first step for potential customers. This process, designed to attract a specific demographic of entrepreneurs and small business owners, needs to be both efficient and engaging. We delve into the mechanics of this signup, examining its strengths and weaknesses, comparing it to competitors, and ultimately assessing whether NorthOne successfully converts potential customers into loyal users.

This analysis covers the step-by-step signup process, highlighting key features and benefits, and evaluating the effectiveness of the visual design and security measures implemented. Furthermore, we’ll explore the post-signup onboarding experience and offer suggestions for improvement across all aspects of the customer journey.

NorthOne Bank Sign-Up Process: A Deep Dive

This article provides an in-depth analysis of the NorthOne Bank sign-up process, examining its target audience, the steps involved, key features, security measures, and post-signup onboarding. We’ll explore both the strengths and weaknesses of the process, offering suggestions for improvement based on best practices in online banking.

NorthOne Bank’s Target Audience

Source: hustlermoneyblog.com

Considering a NorthOne bank sign-up? Before you decide, it’s helpful to compare options. For example, you might want to explore the features of a huntington bank small business checking account to see if it better suits your needs. Ultimately, the best choice for you will depend on your specific business requirements, so careful research before signing up with NorthOne or any other bank is recommended.

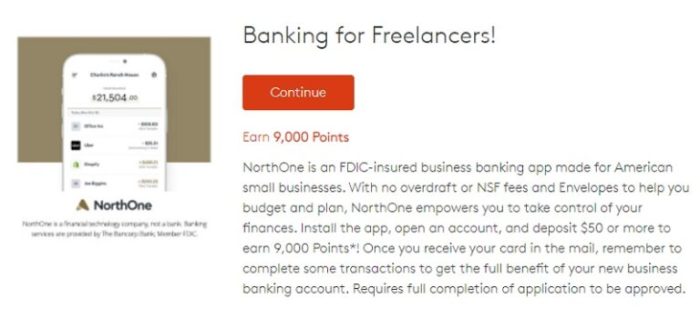

NorthOne Bank primarily targets small business owners and entrepreneurs. This demographic often faces unique banking challenges, including complex accounting needs, limited access to traditional business loans, and a desire for streamlined, technology-driven financial solutions. They often feel underserved by traditional banks, which can have cumbersome onboarding processes and less-than-ideal digital experiences. Compared to banks focusing on personal banking or large corporations, NorthOne’s sign-up process is designed for speed and ease of use, recognizing the time constraints faced by busy business owners.

A typical NorthOne customer might be Sarah, a 35-year-old freelance graphic designer, who values ease of use, mobile accessibility, and transparent fees. Her signup experience would ideally involve a quick, intuitive process, with clear explanations of fees and features, ultimately leading to a feeling of empowerment and control over her finances.

Analyzing the NorthOne Bank Sign-Up Process

Source: cloudfront.net

The NorthOne sign-up process typically involves several key steps. The following table details these steps, highlighting potential challenges and suggesting time estimates.

| Step Number | Action Required | Time Estimate | Potential Challenges |

|---|---|---|---|

| 1 | Visit the NorthOne website and initiate the application. | 1-2 minutes | Website navigation issues, unclear call to action. |

| 2 | Provide basic business information (name, address, EIN/SSN). | 5-7 minutes | Incorrect or incomplete information leading to delays. |

| 3 | Verify business ownership and identity. | 10-15 minutes | Document upload issues, identity verification delays. |

| 4 | Link bank account for funding. | 5 minutes | Issues linking accounts due to bank compatibility. |

| 5 | Review and accept terms and conditions. | 2-3 minutes | Lengthy or unclear terms and conditions. |

| 6 | Account activation and setup. | 5 minutes | Technical glitches preventing account access. |

Friction points might include complex identity verification processes or difficulties linking existing bank accounts. Improvements could include streamlining the document upload process, offering multiple verification options, and providing clear, concise instructions at each step.

Features and Benefits Highlighted During Sign-Up

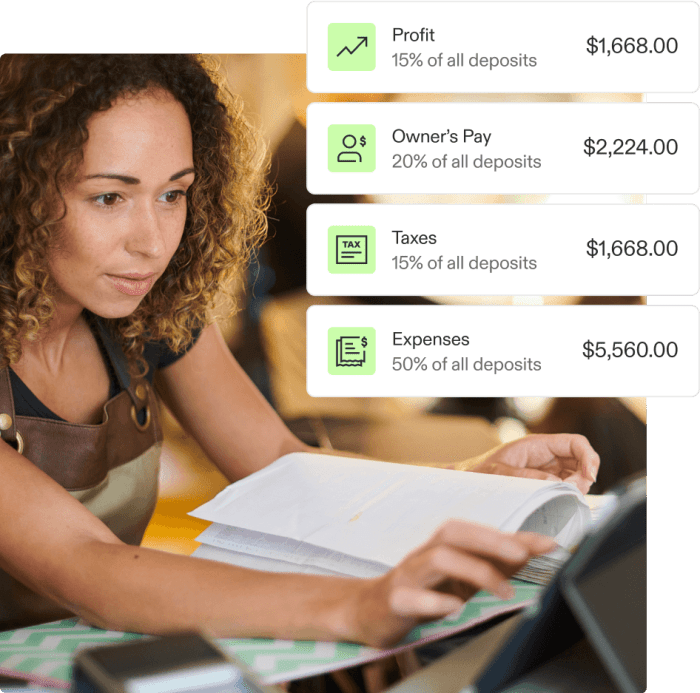

NorthOne typically highlights features such as its intuitive mobile app, robust accounting tools, and transparent pricing during signup. The effectiveness of this presentation varies; while the features are generally useful, the presentation could benefit from more visual appeal. Alternative presentation methods could include short, engaging video tutorials showcasing the app’s functionality and interactive elements demonstrating the ease of use of accounting tools.

Compelling marketing copy could emphasize time savings, such as “Spend less time on paperwork and more time growing your business,” or “Effortless accounting, built for entrepreneurs.”

Security and Trust-Building Measures During Sign-Up

NorthOne employs various security measures, including multi-factor authentication, encryption, and fraud detection systems. These measures build trust by demonstrating a commitment to protecting user data. Compared to some competitors, NorthOne’s security measures are relatively robust, but continuous improvement is essential. A security checklist for online banking sign-up processes should include data encryption during transmission, secure password policies, regular security audits, and transparent communication about security practices.

Post-Sign-Up Onboarding Experience, Northone bank sign up

After signup, NorthOne typically provides a welcome email and access to tutorials and support resources. Improving this experience could involve personalized onboarding based on the user’s business type and needs. Communication methods should include email, in-app notifications, and potentially live chat support. A series of onboarding emails could include: (1) Welcome email with account access details (Subject: Welcome to NorthOne!), (2) Tutorial on key features (Subject: Master Your Finances with NorthOne!), (3) Tips for optimizing business finances (Subject: Grow Your Business with NorthOne Insights!).

Visual Aspects of the Sign-Up Process

The NorthOne sign-up page generally features a clean, modern design with a consistent color scheme (often incorporating shades of blue and green to convey trust and stability). The fonts are easy to read, and the imagery is professional and relevant to the target audience (often depicting diverse entrepreneurs). To enhance visual appeal, consider incorporating more interactive elements, such as progress bars and animated illustrations, to guide users through the process.

A mock-up of an improved sign-up page might include a more visually engaging progress bar, use of high-quality photography showcasing diverse entrepreneurs, and a more prominent display of security badges and trust indicators.

Outcome Summary: Northone Bank Sign Up

Ultimately, the success of NorthOne Bank’s sign-up process hinges on its ability to efficiently onboard new customers while building trust and confidence. By addressing friction points, enhancing the visual appeal, and streamlining the onboarding experience, NorthOne can significantly improve customer acquisition and retention. A smooth and intuitive signup process is not just a convenience; it’s a crucial component of a thriving banking platform in a competitive market.