Cit Bank Savings Promo presents exciting opportunities to grow your hard-earned money. This in-depth look explores current and past promotional offers, comparing them to competitors and analyzing their effectiveness. We’ll delve into the details, examining interest rates, minimum deposit requirements, and promotional periods, ensuring you have all the information you need to make informed decisions about your savings.

From analyzing marketing strategies to highlighting potential customer challenges and offering solutions for improved customer experience, we aim to provide a comprehensive understanding of Cit Bank’s savings promotions. We’ll even share hypothetical examples of promotional emails and infographics to illustrate how these promotions are presented to customers, making it easier for you to navigate the world of savings accounts and maximize your financial growth.

Cit Bank Savings Account Promotions: A Deep Dive

Cit Bank frequently offers enticing promotions on its savings accounts, aiming to attract new customers and reward existing ones. This analysis delves into the specifics of these promotions, comparing them to competitors and assessing their effectiveness. We’ll explore past promotions, analyze marketing strategies, and consider customer experiences to provide a comprehensive overview.

CIT Bank’s current savings promo offers competitive interest rates, making it a tempting option for boosting your savings. Before you jump in, however, it’s crucial to confirm that your funds are secure; checking if is CIT Bank federally insured is a vital first step. Understanding this aspect of their security ensures peace of mind while taking advantage of the attractive CIT Bank savings promo.

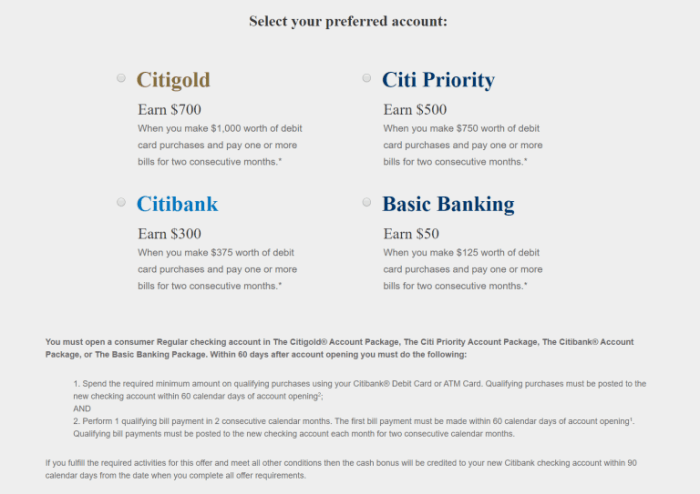

Current Promotions Overview

Source: bankdealguy.com

Cit Bank’s current savings account promotions vary depending on the specific account type and may include increased interest rates for a limited time, bonus incentives for new deposits, or rewards for maintaining a minimum balance. Eligibility criteria often involve opening a new account, meeting minimum deposit requirements, or maintaining a minimum balance throughout the promotional period. Specific details are subject to change and should be verified directly on the Cit Bank website.

| Account Type | Interest Rate | Minimum Deposit | Promotional Period |

|---|---|---|---|

| High-Yield Savings | 3.00% APY (example) | $1,000 (example) | 6 months (example) |

| Premier Savings | 2.50% APY (example) | $5,000 (example) | 12 months (example) |

| Basic Savings | 1.00% APY (example) | $100 (example) | 3 months (example) |

| Money Market Account | 2.75% APY (example) | $2,500 (example) | 9 months (example) |

Historical Promotional Data, Cit bank savings promo

Analyzing past Cit Bank savings promotions reveals a trend of offering higher interest rates during periods of economic uncertainty or increased competition. Promotions have also included bonus cash incentives for new deposits, and tiered interest rates based on account balance. Eligibility criteria have generally remained consistent, focusing on minimum deposit requirements and account tenure.

For example, a past promotion might have offered a 4.00% APY for a 3-month period with a $1000 minimum deposit, whereas a later promotion might have reduced the interest rate to 3.5% but extended the promotional period to 6 months.

Comparison with Competitors

Cit Bank’s savings account promotions are comparable to those offered by major competitors, but with some key differences. A comparison with three competitors (Bank A, Bank B, and Bank C) highlights these variations.

- Bank A: Offers consistently higher interest rates but often with stricter eligibility requirements.

- Bank B: Provides similar interest rates to Cit Bank but includes bonus features like cashback rewards.

- Bank C: Offers lower interest rates but emphasizes ease of account opening and management.

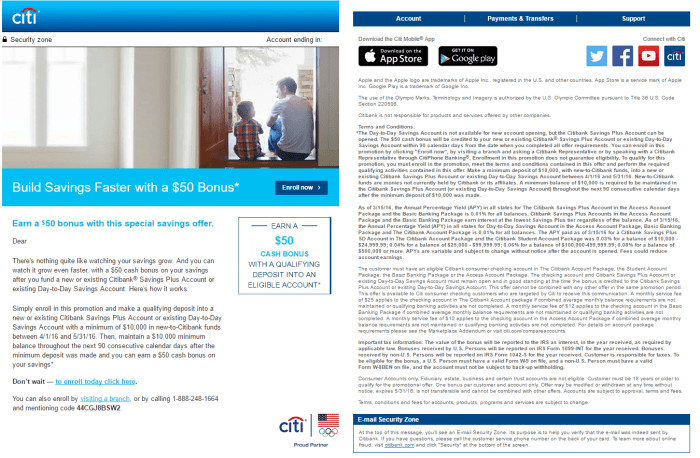

Promotional Materials Analysis

Source: hustlermoneyblog.com

Cit Bank’s promotional materials typically employ clear and concise language, highlighting the key benefits of its savings accounts, such as high interest rates and ease of access. The messaging focuses on financial security and growth. However, the materials could benefit from more targeted messaging tailored to specific demographics.

Customer Experience and Feedback

A hypothetical testimonial from a satisfied customer might read: “I recently took advantage of Cit Bank’s promotional interest rate on their High-Yield Savings account. The process was straightforward, and I was impressed with the ease of online banking. The higher interest rate significantly boosted my savings in just a few months!”

Potential challenges include navigating the terms and conditions of the promotions and ensuring compliance with eligibility requirements. Improving customer experience involves providing clear and concise information, offering excellent customer support, and simplifying the account opening process.

Illustrative Examples

Source: hustlermoneyblog.com

Hypothetical Promotional Email: Subject: Earn More with Cit Bank’s High-Yield Savings! Body: Unlock a higher interest rate on your savings with our limited-time promotion! Earn [interest rate]% APY for [duration] on balances of [amount] or more. Open your account today and start earning more!

Descriptive Infographic: Step 1: Visit Cit Bank’s website. Step 2: Choose your savings account. Step 3: Meet the minimum deposit requirement. Step 4: Enjoy the promotional interest rate for the specified period.

Last Point: Cit Bank Savings Promo

Ultimately, understanding Cit Bank’s savings promotions involves more than just comparing numbers; it’s about recognizing the bigger picture. By analyzing past trends, competitive offerings, and customer feedback, we can gain valuable insights into how to best utilize these promotions. Whether you’re a student starting to save or a retiree looking for the best returns, this analysis provides the knowledge to make your money work harder for you.

So, take advantage of the information presented here and embark on your journey towards a brighter financial future.