Cit bank account types – Citibank account types offer a diverse landscape of financial solutions, each carefully designed to navigate the unique currents of your financial life. From the steady stream of a checking account to the accumulating wealth of a savings account, and the strategic growth of a Certificate of Deposit, Citibank provides a comprehensive range of options tailored to meet individual needs and aspirations.

This exploration unveils the possibilities, empowering you to chart your course towards financial well-being.

Understanding the nuances of each account type – checking, savings, money market, and CDs – is key to unlocking your financial potential. This guide will illuminate the features, benefits, and considerations of each, enabling you to make informed decisions that align with your personal financial goals. Whether you’re a student starting out, a young professional building a future, or an experienced investor seeking stability, Citibank offers a path to financial success.

Citibank Account Types: A Comprehensive Overview: Cit Bank Account Types

Citibank offers a range of accounts designed to cater to diverse financial needs. From basic checking accounts to sophisticated investment options, understanding the available choices is crucial for selecting the best fit. This guide provides a detailed breakdown of Citibank’s account offerings, highlighting key features, fees, and benefits.

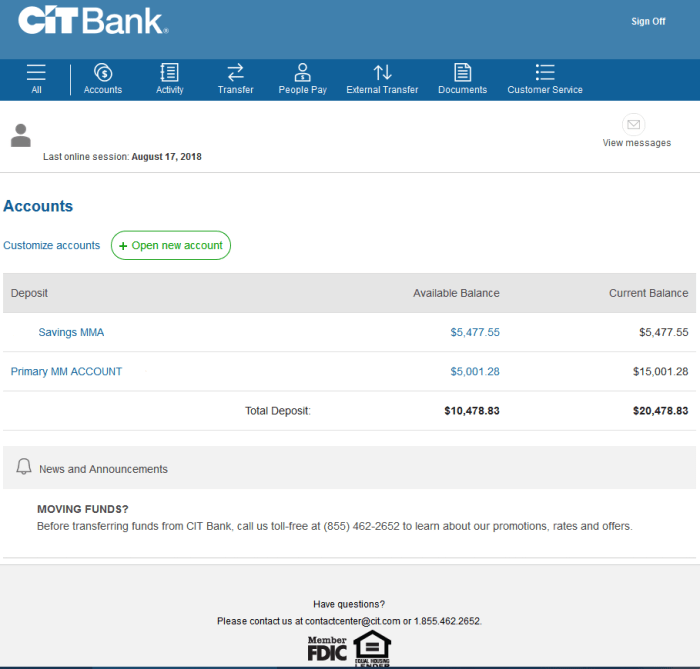

Citibank Account Overview

Source: retirebeforedad.com

Citibank provides a variety of accounts, including checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). Each account type offers unique features and benefits tailored to specific financial goals. Understanding these differences is key to choosing the right account for your individual needs.

| Account Name | Monthly Fee | Minimum Balance | Interest Rate (Annual Percentage Yield) |

|---|---|---|---|

| Basic Checking | $0-$10 (depending on specific account) | $0 | 0% |

| Premium Checking | $25-$50 (depending on specific account) | $25,000 – $50,000 | 0.01%-0.05% (variable) |

| Savings Account | $0 | $0 | 0.01%-0.10% (variable) |

| Money Market Account | $0-$25 (depending on specific account) | $1,000-$2,500 | 0.05%-0.20% (variable) |

| CD (1-year term) | $0 | Variable, depending on CD amount | 0.5%-2% (fixed) |

Note

Interest rates and fees are subject to change. Contact Citibank directly for the most up-to-date information.*

Checking Accounts at Citibank

Citibank’s checking accounts offer various features to manage daily finances efficiently. Options include basic checking, premium checking, and student checking accounts, each with different fee structures and benefits. Overdraft protection is available for added security, helping to prevent insufficient funds situations.

| Feature | Basic Checking | Premium Checking | Student Checking |

|---|---|---|---|

| Monthly Fee | $0-$10 | $25-$50 | $0 |

| ATM Fees | Waived at Citibank ATMs, fees at other ATMs | Waived at Citibank and many partner ATMs | Waived at Citibank ATMs, fees at other ATMs |

| Mobile Banking | Yes | Yes | Yes |

| Debit Card | Yes | Yes, often with enhanced benefits | Yes |

| Overdraft Protection | Available | Available | Available |

Savings Accounts at Citibank

Citibank’s savings accounts provide a secure place to save money and earn interest. These accounts are designed for easy access to funds while offering competitive interest rates. The accessibility of funds is a key benefit, allowing for easy transfers and withdrawals as needed.

- Interest Rates: Variable, typically ranging from 0.01% to 0.10% APY.

- Minimum Balance Requirements: Generally $0, although some accounts may have higher minimums for certain benefits.

- Fees: Typically no monthly fees.

Citibank Money Market Accounts, Cit bank account types

Citibank’s money market accounts offer a balance between liquidity and higher interest rates compared to standard savings accounts. While they provide check-writing capabilities, transaction limits may apply.

| Feature | Savings Account | Money Market Account |

|---|---|---|

| Interest Rate | Generally lower | Generally higher |

| Transaction Limits | Typically unlimited | May have limits on withdrawals or checks written |

| Minimum Balance | Usually lower | Usually higher |

Citibank CD (Certificate of Deposit) Accounts

Source: moneymint.com

Citibank CDs offer fixed interest rates over a specified term. While they provide higher returns than savings accounts, early withdrawals typically incur penalties. The potential earnings depend on the chosen term length and interest rate.

Example: A $10,000 CD with a 2% annual interest rate for a 5-year term would earn approximately $1,000 in interest ($10,000 x 0.02 x 5). However, withdrawing early would result in a penalty, reducing the overall earnings.

Citibank Account Opening Process

Source: cloudfront.net

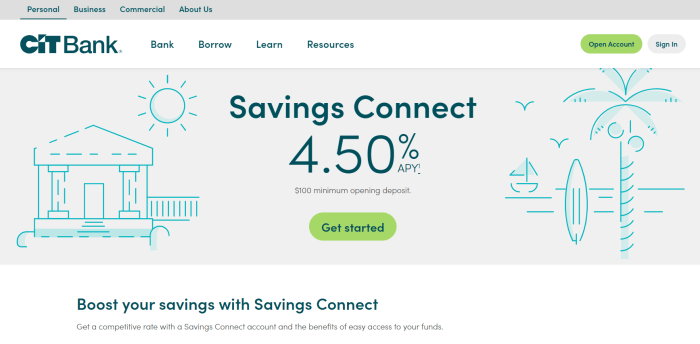

Choosing the right CIT Bank account type can feel overwhelming, but understanding your financial goals is key. Do you prioritize accessibility or maximizing returns? A crucial factor in this decision is, of course, the interest rate CIT Bank offers on its various accounts. This information will help you weigh the benefits of each account type and select the one that best suits your needs and desired interest earnings.

Opening a Citibank account is straightforward, with options for online and in-person applications. Required documentation typically includes identification, proof of address, and social security number. Online applications offer convenience, while in-person applications allow for direct assistance from a representative.

Citibank Account Management

Citibank provides multiple convenient ways to manage accounts. Online banking and the mobile app allow for 24/7 access to account information, transaction history, and funds transfers. Phone banking offers another option for account management and customer service.

Citibank Customer Service

Citibank offers various customer service channels, including phone, email, and online chat. Customer service hours vary, and details are available on the Citibank website. Reporting lost or stolen cards should be done immediately through the appropriate channels (phone or online).

Closing Summary

Embarking on your financial journey with Citibank means choosing from a robust selection of accounts designed to support your every step. By carefully considering your individual needs and matching them to the appropriate account type, you can build a strong foundation for financial security and prosperity. Remember, understanding your options is the first step towards achieving your financial dreams.

With Citibank, the possibilities are vast, and your financial future is within reach.